Non-Owner Auto Insurance is a type of insurance policy that provides coverage for individuals who don’t own a car but still need insurance coverage. This type of insurance policy typically provides liability coverage that pays for damages you cause to others in an accident while driving a car that you don’t own. It does not cover damages to the car you’re driving or any injuries you sustain in an accident.

Non-Owner Auto Insurance is often purchased by people who frequently rent cars or borrow vehicles from friends or family members, or who use car-sharing services. This type of insurance can also be useful for people who want to maintain continuous auto insurance coverage even if they don’t currently own a car, as some insurance companies may consider a lapse in coverage when determining rates.

As the automotive industry continues to undergo significant transformations, traditional notions of vehicle ownership are changing. With the rise of ride-sharing services, car rentals, and urban living, more and more individuals are opting not to own a personal vehicle. In response to this trend, the insurance sector has adapted by offering Non-Owner Auto Insurance policies. In this article, we will explore the statistics, facts, trends, and data surrounding Non-Owner Auto Insurance to shed light on this emerging facet of the insurance market.

Definition and Scope of Non-Owner Auto Insurance

Non-Owner Auto Insurance is a specialized type of insurance policy that provides coverage for individuals who regularly drive but do not own a vehicle. This coverage is designed to protect non-owners from potential liability in case of accidents while driving borrowed or rented vehicles.

Non-Owner Auto Insurance is a specialized type of insurance policy that provides coverage for individuals who regularly drive but do not own a vehicle. This coverage is designed to protect non-owners from potential liability in case of accidents while driving borrowed or rented vehicles.

Growing Trend of Non-Ownership

The rise of non-ownership is a significant trend in recent years. According to a study conducted by McKinsey & Company, the number of car-sharing users in North America and Europe is projected to exceed 36 million by 2025, indicating a growing shift away from personal vehicle ownership.

Urbanization and Non-Owner Auto Insurance

Urbanization has played a crucial role in the popularity of Non-Owner Auto Insurance. As more people migrate to cities, owning a car becomes less practical due to limited parking, increased congestion, and the availability of public transportation options. According to the United Nations, over 68% of the global population is projected to live in urban areas by 2050, further driving the demand for Non-Owner Auto Insurance.

Cost-Effectiveness of Non-Owner Auto Insurance

Non-Owner Auto Insurance is often more cost-effective than traditional auto insurance. For individuals who do not drive frequently or do not own a vehicle, paying high premiums for standard auto insurance can be financially burdensome. Non-owner policies typically provide liability coverage at a lower cost, making it an attractive option for budget-conscious drivers.

Liability Coverage and Legal Requirements

Many jurisdictions require all drivers to carry a minimum amount of liability insurance to cover damages they may cause in an accident. Non-Owner Auto Insurance fulfills these legal requirements for drivers who do not own a vehicle but still wish to be covered while driving.

The Role of Ride-Sharing Companies

The proliferation of ride-sharing companies such as Uber and Lyft has contributed significantly to the growth of Non-Owner Auto Insurance. Many ride-sharing drivers opt for these policies to ensure they are protected when they are not actively using their vehicles for business purposes.

Insurance Providers and Market Response

Major insurance companies have recognized the increasing demand for Non-Owner Auto Insurance and have tailored policies to cater to this emerging market. Many providers now offer customizable plans that allow individuals to purchase coverage for specific periods, such as hourly, daily, or monthly.

Coverage Limitations

It’s essential for individuals considering Non-Owner Auto Insurance to be aware of its limitations. These policies typically only offer liability coverage and do not include comprehensive or collision coverage. Additionally, if the driver lives with a household member who owns a vehicle, the non-owner policy might not provide coverage when driving that family member’s car.

Geographic and Demographic Trends

Geographically, Non-Owner Auto Insurance tends to be more popular in densely populated urban areas where public transportation is readily available. Demographically, it is commonly chosen by younger individuals, students, and those who prefer alternative transportation options.

3 Best Ways Non-Owner Insurance Affects Premiums

Non-owner insurance can play an essential role in shaping your premiums. By maintaining continuous coverage, you can build a favorable insurance history that insurers appreciate. Additionally, managing SR-22 requirements with affordable options can further influence your rates. Finally, customizing your coverage can lead to more effective rate negotiations. Understanding these factors can help you make informed decisions about your insurance strategy, but the nuances of each approach warrant closer examination.

-

1 – Maintaining Continuous Coverage to Reduce Future Premiums

While you may not own a vehicle, maintaining continuous non-owner insurance coverage is vital for managing your future premiums effectively. By preventing coverage gaps, you keep your insurance history intact, which can help you secure lower rates in the future. Continuous coverage guarantees that your premiums remain stable, as insurers view a consistent record more favorably. Moreover, this approach meets legal requirements, avoiding penalties that could lead to increased costs. Additionally, having non-owner car insurance demonstrates responsible behavior through continuous insurance, which can lower your perceived risk to insurers, benefiting your overall rate. Insurers often reward those with a clean driving record, which can further enhance your potential discounts. Ultimately, maintaining active coverage, even without a vehicle, positions you better for long-term savings and a more favorable insurance experience when you need it.

-

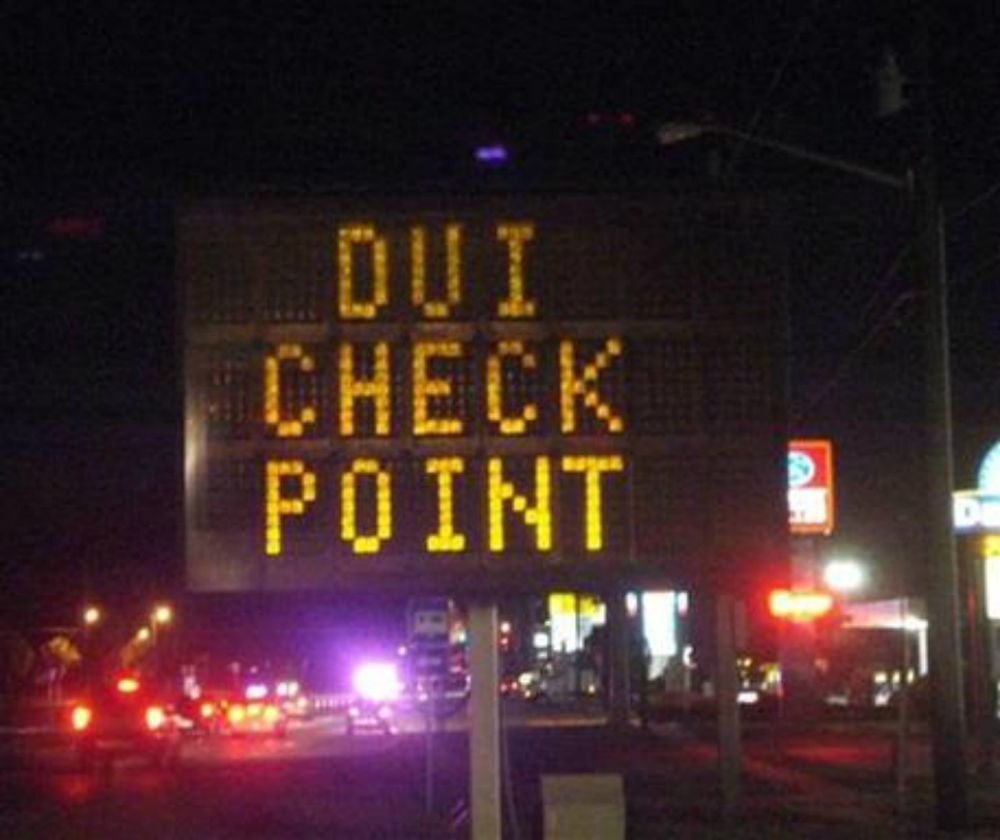

2 – Managing SR-22 Requirements With Affordable Options

To navigate the complexities of SR-22 requirements effectively, understanding your options for affordable non-owner SR-22 insurance is vital. Non-owner SR-22 insurance offers liability coverage for drivers without vehicles, making it a practical choice after serious violations such as DUIs. The average annual cost for this policy is about $382, including the SR-22 filing fee of approximately $25. To find the best rates, compare quotes from multiple insurers, as some specialize in high-risk drivers. It’s important to verify the insurer can file the SR-22 form for non-owner policies.

-

3 – Customizing Coverage for Better Rate Negotiation

Customizing your non-owner insurance coverage is essential for negotiating better rates and ensuring adequate protection. Start by analyzing core components like liability coverage, which is typically mandatory. Consider adding uninsured/underinsured motorist protection to cover injuries from inadequately insured drivers. Adjusting coverage amounts can directly impact your premiums; lower limits reduce costs but may leave you vulnerable. Evaluate your driving frequency and insurance needs—frequent renters and car-sharing users often find non-owner insurance more economical than rental options. Don’t forget to explore discounts for bundling policies or maintaining a good driving record. Comparing quotes from various providers, including local options, helps you find the best deal tailored to your circumstances, ensuring you get the coverage you truly need.

Conclusion

In conclusion, non-owner insurance plays an essential role in shaping your premiums. By maintaining continuous coverage, you not only create a favorable insurance history but also enhance your negotiating power. Notably, drivers with non-owner policies can save up to 20% on their premiums compared to those without. By managing SR-22 requirements effectively and customizing your coverage, you can further optimize your insurance costs. Ultimately, being proactive with non-owner insurance can lead to significant long-term financial benefits.

Non-Owner Auto Insurance has emerged as a vital solution for those who opt not to own a personal vehicle but still need occasional access to a car. With urbanization, ride-sharing, and changing attitudes towards vehicle ownership, this trend is expected to continue growing. As the insurance industry adapts to these shifts, Non-Owner Auto Insurance will likely become an increasingly integral part of the insurance landscape, offering flexible and cost-effective coverage for a diverse range of drivers.

Other Types of Non-Owner Insurance: the Non Owner SR-22 Insurance Policy

Non Owner SR-22 Insurance is a type of policy which is specifically designed for individuals who do not own a car. This type of insurance is an attractive option for individuals who do not plan on buying a car anytime soon but may need to drive one owned by someone else on a regular basis. This type of policy protects the driver and the car owner from liability if an accident occurs while the driver is operating the car. This type of insurance is also great for those who rent a car, borrow one from a friend or family member, or occasionally drive a commercial vehicle.

The Non Owner SR22 Insurance policy provides protection in the event of an at-fault accident. It pays for the damages that the driver is liable for, and can be used to protect the driver from claims of property damage or injury as well. It also covers the expenses related to a lawsuit should one occur. The Non Owner SR-22 Insurance policy also pays for medical expenses in the event of a car accident, even if the driver is not at fault.

Non Owner SR-22 Insurance is a great way to get liability coverage without the expense of owning a car. It also gives the driver the confidence to get on the road without having to worry about financial losses if an accident were to occur. The cost of the policy also tends to be much lower than the cost of traditional car insurance, making it more affordable for those who may not have extra money in their budget for car insurance.

The frequently asked questions section of the Non Owner SR-22 Insurance policy helps individuals understand what the policy does and doesn’t cover. It’s important to read the small print before signing up to ensure that the policy meets the driver’s needs. Furthermore, it’s important to be aware that the policy may not cover certain types of accidents such as those caused by an intoxicated driver, or those involving uninsured or underinsured motorists.

These types of policies can be applied for quickly and easily online. The process usually takes just a few minutes to complete, and in many cases the policies can be completed the same day. The policy itself also only needs to be purchased for a specific amount of time as opposed to a longer term policy which may be required in some cases.

Besides, Non Owner SR-22 Insurance policies have certain restrictions when it comes to who can obtain them. For example, those with a suspended license due to a DUI or DWI will not be eligible to obtain this type of policy. Likewise, those who have had multiple traffic violations in a short period of time may be unable to get this type of policy.

Another section focuses on the benefits of choosing Non Owner SR-22 Insurance. It explains how insurance companies offer discounts for policyholders with good driving records, and how the policy can even help individuals who have spotty driving records build better credit. Additionally, this section explains how individuals who decide to purchase this type of policy can often save money by selecting a deductible or adding additional riders to the policy.

Moreover, Non Owner SR-22 Insurance is an ideal choice for those who don’t need full coverage. This type of policy provides basic protection for those times when you have to drive a car that you don’t own. It can also provide peace of mind knowing that if an accident does occur, you won’t be stuck footing the bill for the damages.

In addition, there are many questions that rise regarding the type of protection provided by the Non Owner SR-22 Insurance. For instance, Does it cover property damage? Does it cover medical bills? Is there coverage for towing and roadside assistance? Does the policy cover rental cars?

Therefore, it’s important to fully explore the Non Owner SR-22 Insurance policy before signing up. The coverage provided by this type of policy can help you stay safe on the road and be better protected in the event of an accident. It’s important to understand the policy’s details and remember that this coverage isn’t the same as a standard car insurance policy, so it pays to do your research.

Furthermore, it is important to note that Non Owner SR-22 Insurance is not the only type of insurance available to individuals who do not own a car. There are other policies such as renters insurance, motorcycle insurance, and non-owner automobile liability insurance which can provide similar, or even better coverage for those who don’t own a car and are looking for an insurance policy to meet their needs.

In conclusion, Non Owner SR-22 Insurance is a great option for individuals who don’t own a car but may need coverage on occasion. This type of policy offers liability protection to protect you from accident-related expenses such as medical or property damage bills. Additionally, it can offer discounts to individuals with a good driving record and still prove to be more affordable than a standard car insurance policy.

Finally, it’s important to shop around and compare different policies to ensure that the Non Owner SR-22 Insurance policy meets all of one’s needs. Understanding the details of the policy is essential to properly protect oneself against any unfortunate accidents that may occur while driving.

In order to gain more knowledge about Non Owner SR-22 Insurance, it is beneficial to talk to an experienced insurance broker. A knowledgeable broker can explain the various policy options and suggest the best coverage for one’s individual needs, making the process easier and less overwhelming. Additionally, having a professional broker helping can reduce the chances of selecting an incorrect policy which could potentially leave an individual unprotected and facing high costs after an accident.

Moreover, individuals can also review customer service ratings for different policy providers to make sure that they are choosing a company with a history of excellent customer service. Reviews from other customers provide valuable information about the quality of customer service, which can help when making an informed decision on what type of policy is best for one’s needs.

In addition, interested individuals should also look into the different discounts available. Companies often offer discounts for a variety of plans and policy options, including discounts for defensive driving courses, good student discounts, multi-policy discounts, and other incentives. Taking the time to compare all of the discounts and incentives between different companies can make a big difference in the overall cost of a policy, and can help one get more for their money.

It is also a good idea to research the terms and conditions of the policy before signing a contract. Understanding all the policies and provisions of the policy chosen will help make sure that the policy fits the individual’s needs, and that it is the best fit for the situation. Being informed is key in making sure that one gets the most out of the policy chosen.

Last but not least, with Non Owner SR-22 Insurance, it is essential to remember that every state has its own regulations regarding this type of policy. Each state has its own limits on the types of coverage provided, as well as different rules and regulations regarding Non Owner SR-22 policies. Before signing any contracts or coverage plans, be sure to check with your state’s insurance department to make sure the coverage plan chosen meets all the necessary state requirements.

Non Owner SR-22 Insurance is an excellent option for those who don’t currently own a car but occasionally need to drive. By being aware of the details of the policy, understanding all the possible discounts and incentives, and researching the state’s specific provisions, individuals can find the right policy to suit their needs and get the best value out of their Non Owner SR-22 Insurance policy.

Frequently Asked Questions about Non-Owner Auto Insurance

What does Non-Owner Auto Insurance cover?

Non-Owner Auto Insurance typically covers liability for bodily injury and property damage you cause to others while driving a car that you don’t own.

What does Non-Owner Auto Insurance NOT cover?

Non-Owner Auto Insurance typically does not cover damages to the car you’re driving or any injuries you sustain in an accident.

Who needs Non-Owner Auto Insurance?

Non-Owner Auto Insurance may be a good option for people who frequently rent cars, borrow vehicles from friends or family members, or use car-sharing services.

How much does Non-Owner Auto Insurance cost?

The cost of Non-Owner Auto Insurance varies depending on factors such as your driving record, the amount of liability coverage you choose, and the insurance company you select.

Is Non-Owner Auto Insurance required by law?

Non-Owner Auto Insurance is not required by law in most states, but some states may require drivers to carry liability insurance even if they don’t own a car.

Can I use Non-Owner Auto Insurance to drive any car?

Non-Owner Auto Insurance typically covers you when driving a car that you don’t own, but some insurance policies may have restrictions or exclusions.

What happens if I get into an accident while driving a car that’s not mine?

If you cause an accident while driving a car that’s not yours, your Non-Owner Auto Insurance policy may provide liability coverage for damages you cause to others.

Can Non-Owner Auto Insurance cover rental cars?

Yes, Non-Owner Auto Insurance can cover rental cars, but you should check with your insurance company to make sure your policy provides this coverage.

Does Non-Owner Auto Insurance cover me if I’m driving for work?

Non-Owner Auto Insurance typically does not cover you if you’re driving for work, as this may require commercial auto insurance.

How does Non-Owner Auto Insurance work with my personal auto insurance?

If you have personal auto insurance, your Non-Owner Auto Insurance policy may provide secondary liability coverage when driving a car that’s not yours.

Can I add Non-Owner Auto Insurance to my personal auto insurance policy?

Some insurance companies may offer Non-Owner Auto Insurance as an add-on to a personal auto insurance policy, but not all companies provide this option.

What should I consider when choosing a Non-Owner Auto Insurance policy?

When choosing a Non-Owner Auto Insurance policy, you should consider factors such as the amount of liability coverage, the cost of the policy, and the reputation of the insurance company.

How can I find the best Non-Owner Auto Insurance policy?

To find the best Non-Owner Auto Insurance policy, you can compare quotes from multiple insurance companies, read customer reviews, and ask for recommendations from friends or family members.

How long does Non-Owner Auto Insurance coverage last?

Non-Owner Auto Insurance policies typically last for a set period of time, such as six months or a year, and must be renewed if you want to continue coverage.

Can I cancel my Non-Owner Auto Insurance policy at any time?

You may be able to cancel your Non-Owner Auto Insurance policy at any time, but you should check with your insurance company to find out if there are any fees or penalties for doing so.